Hi there,

Last week's newsletter about stopping the chase for AI use cases (and starting to look for profit instead) struck a chord. Seems I'm not the only one who's tired of seeing AI projects with zero impact. But it also triggered an important question:

How do you actually assess the total value of an AI initiative?

After all, there's more to consider than the financial side, right? Well, yes and no. "Soft" benefits (like employee satisfaction) aren't really alternatives - they're multipliers. If you can't drive profit, then all your multipliers will just equal zero.

Today, I'll show you the stack I use to estimate the total value of an AI initiative through a profit-first lens. Plus, I'll give you a simple equation to take away.

Let's dive in!

The Common Mistake in AI Business Cases

Here's how most organizations build their AI business cases today:

They list every possible benefit they can think of:

💸 $50K savings in labor costs

🥳 20% better customer satisfaction

🤝 15% higher employee retention

💡 "Innovation leadership"

🔮 "Future-proof organization"

Then they add it all up, trying to reach some magical ROI threshold that gets their project approved.

The problem with that is that this approach treats all benefits as equal and independent. As if you could achieve better customer satisfaction or innovation leadership without first having a solution that delivers hard results.

Let me show you a quick example:

A B2B SaaS wanted to implement an AI document classification. Their business case looked like this:

Cost savings: $20K per month

Customer satisfaction improvement: $30K "value"

Employee satisfaction boost: $20K "value"

Innovation benefit: $15K "value"

Total: $1M "value" per year!

Sounds impressive. But here's what actually happened: Because the basic solution wasn't profitable enough (only ~$240K hard savings vs. ~$250K yearly costs for the AI solution), the project was deemed "too risky" and got killed. No amount of "soft benefits" could compensate for the lack of core profitability.

There's a better way to think about this.

The AI Profit Stack: A Better Way to Calculate "Value"

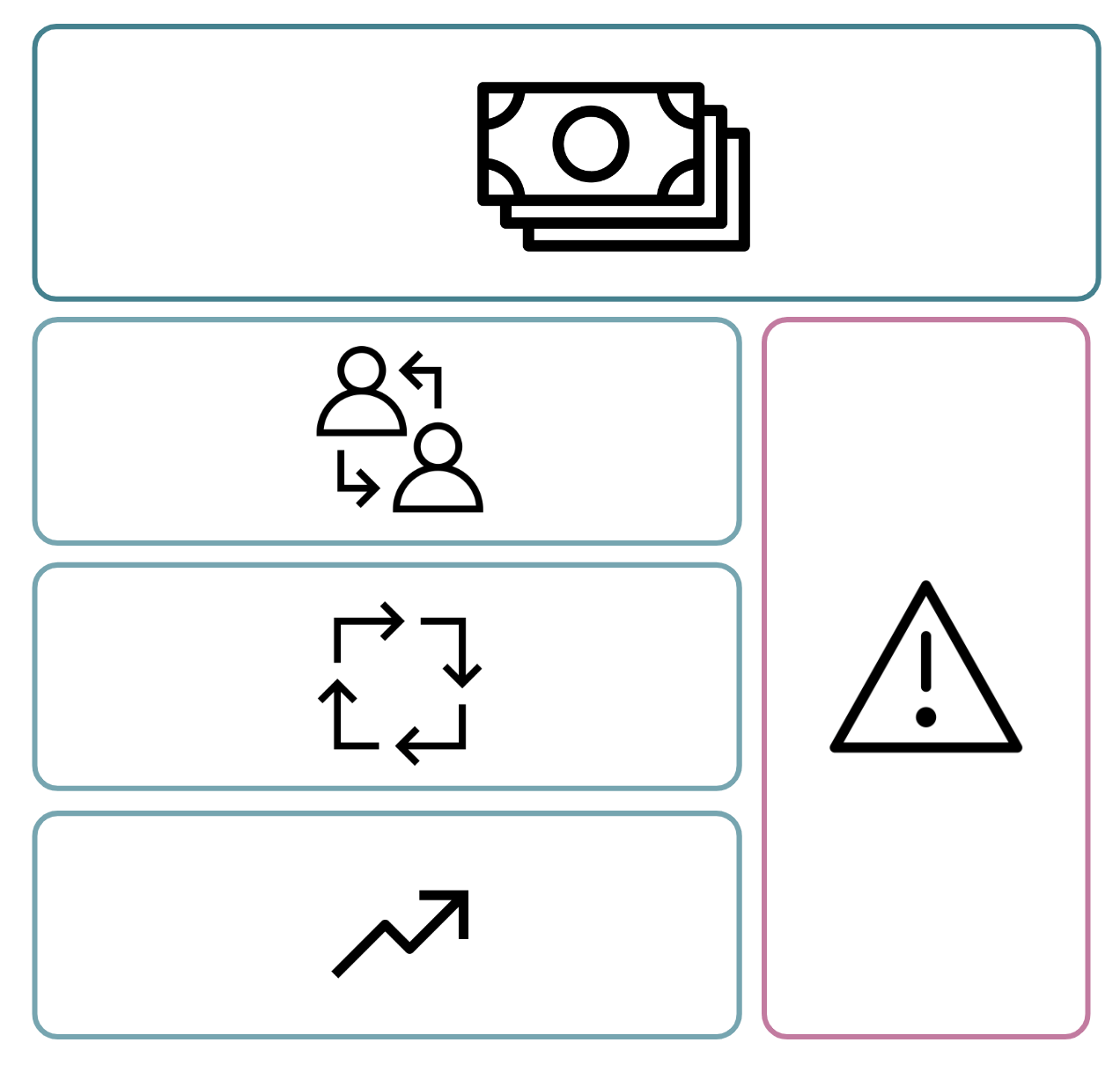

Instead of randomly bagging up benefits, think of AI value as a stack that builds from a solid profit foundation. Each layer acts as a multiplier that can increase your base profit - but only if that profit exists in the first place.

Here's how the stack works:

Financial Impact (The Foundation)

Cost savings

Revenue gains

Simple.

Your base profit must exceed your value threshold, e. g. $10K monthly (remember our rule from last week?). If it does, consider these factors:

Customer Experience (First Multiplier)

Better service quality

Faster response times

24/7 availability

etc.

Process Excellence (Second Multiplier)

Higher efficiency

Fewer errors

Better consistency

etc.

Growth Impact (Third Multiplier)

New capabilities

Scalability potential

Innovation opportunities

etc.

Risk Factor (Reality Check)

Implementation complexity

Adoption challenges

Time to value

Legal risks

etc.

Think of it like a building: You need a solid foundation (profit) first, before you can add floors (multipliers) later. And each floor doesn't just sit there - it adds to the value of the whole building.

Let’s see how we can calculate these multipliers concretely.

The AI Value Equation

Remember our core principle: each layer is a multiplier to your base profit. Here's how to calculate it:

Total Value = Recurring Profit × ∑(Support Multipliers) × Risk Factor

Let's break this down:

1. Start with Recurring Profit

This is your foundation - the direct financial impact from cost savings, or revenue gains. Remember: this needs to exceed your threshold!

2. Add Support Multipliers

Each support factor can add 0.1 to 0.3* to your base value:

Customer Excellence (better service, faster response)

Process Excellence (fewer errors, more consistency)

Growth Impact (scalability, new capabilities)

For example, if your AI project delivers strong customer and process improvements but only moderate growth potential, you might have: (1 + 0.3 + 0.3 + 0.1) = 1.7x multiplier

* feel free to adjust these ranges as you like. The logic I’m using is that all three multipliers can at most roughly double your baseline, which is already quite ambitious.

3. Apply Risk Factor

Finally, multiply everything by a risk factor between 0.0 and 1.0 based on:

Implementation complexity

Adoption challenges

Time to value

This will keep your calculation grounded in reality - or it could turn into a zero-sum game where your risks eat up all your expected gains. In this case, focus on risk management before prioritizing the project.

The AI Value Equation in Action

Let's look at an example I've dealt with multiple times in my consulting work: A first-level support chatbot. This is actually one of the most common (Generative) AI use cases, with Gartner predicting that 80% of customer service interactions will involve AI by 2025.

But while everyone implements chatbots, most companies struggle to make them profitable because they focus on the wrong metrics. That’s why many projects are stalled in the prototyping phase.

A typical scenario.

Background:

Mid-sized B2B (1,000 employees)

Professional services industry

5,000 support tickets per month

Challenges: Rising support cost, increasing customer expectations for 24/7 service, most support work done by subject matter experts who don't see themselves as customer support agents.

The company is considering an AI chatbot for first-level support. The question is: Will it create real value?

Let's run it through our AI Profit Stack:

1. Calculate Recurring Profit

Current cost per ticket: $15

Monthly tickets: 5,000

Total support cost: $75,000

Assumption: AI handles 20% of tickets

Base profit: $15,000 monthly savings

2. Evaluate Support Multipliers

Customer Excellence: +0.2

✅ 24/7 instant response times

✅ Multiple languages supported

Process Excellence: +0.3

✅ Standardized first responses

✅ Automatic ticket categorization

✅ Better agent focus on complex cases

Growth Impact: +0.2

✅ Transferrable to other departments

✅ Rich customer interaction data

Total multiplier: (1 + 0.2 + 0.3 + 0.2) = 1.7x

3. Assess Risk Factor

Implementation complexity: Medium

Adoption challenges: High

Time to value: Fast

Risk factor: 0.5

Final Calculation:

$15,000 × 1.7 × 0.5 = $12,750 monthly total value

So while your direct savings are $15,000, the total value potential is closer to ~$13,000/month considering the support multipliers and risk factors

In this case, $13k should be our guideline when considering AI tools and solutions for this. If you're looking to get ROI within 6 months, that means your AI solution should not cost much more than ~$70k all-in, incl. setup, deployment and maintenance.

(Modern chatbots would cost closer to $10k so this use case should be a no-brainer.)

See how approaching an AI solution like this becomes much more tangible?

Conclusion

The best AI projects are profit-first, "soft" factors second.

Backed by solid multipliers and a realistic risk assessment, you can quickly cut through your "list of use cases" and identify which ones are actually worth pursuing.

By the way, that's exactly what we'll do in my upcoming workshop "Your $10K AI Opportunity". There, I'll show you how to identify a low-hanging fruit AI opportunity, validate it using the Profit Stack, and create an action plan to capture that value.

See you next Friday!

Tobias